A New Data Signal for Insurance Risk

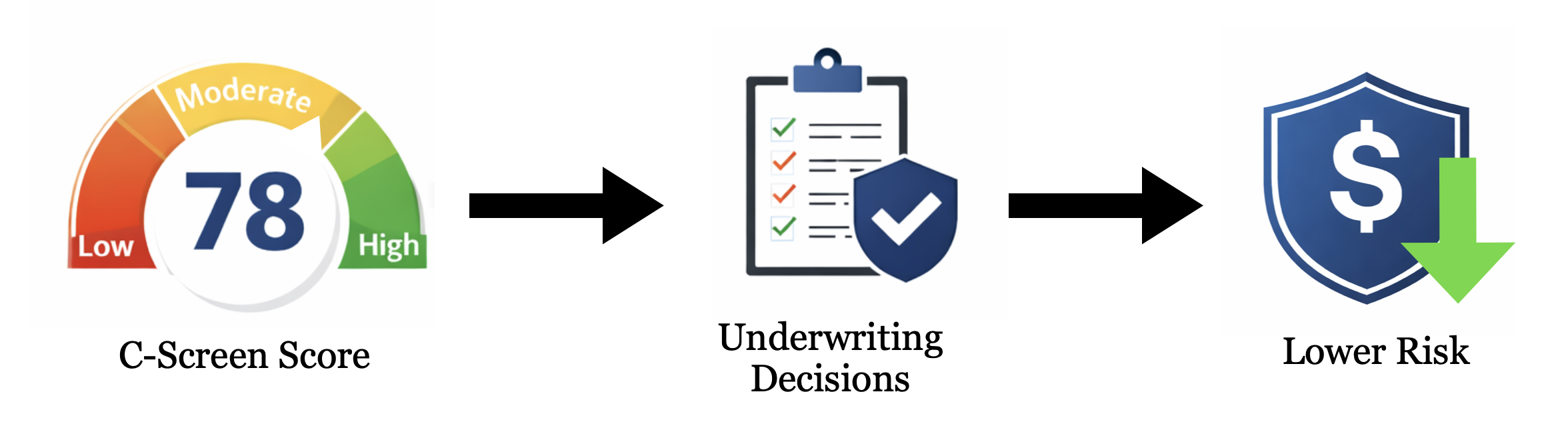

C-Screen helps insurers understand how thoroughly organizations screen the people they hire, revealing workforce risk before it becomes loss.

Why C-Screen Matters for Insurance

C-Screen introduces a defensible, evidence-based data point that strengthens underwriting and risk decision-making.

Grounded in behavioral research and applied consistently, C-Screen helps insurers gain greater confidence in risk selection, portfolio management, and loss prevention strategies.

This isn’t about replacing traditional underwriting. It’s about strengthening it.

Workforce Risk Is a Blind Spot in Traditional Underwriting

In many high-severity claims, the root cause isn’t equipment, facilities, or policy limits. It’s people.

Yet most underwriting decisions still rely on lagging indicators like loss history, payroll, and class codes. These data points offer little visibility into how well an organization manages hiring and screening risk before an incident occurs.

Without insight into workforce screening practices, insurers are left underwriting exposure they can’t fully see.

Where C-Screen Fits

C-Screen supports multiple insurance functions:

• Underwriting – Add a new variable to risk selection and pricing decisions

• Risk Control – Identify screening gaps and improvement opportunities

• Portfolio Management – Gain clearer visibility into workforce-driven exposure

• Broker Conversations – Support clearer, data-backed discussions with clients

Turning Hiring Practices Into Actionable Risk Data

C-Screen evaluates how thoroughly an organization screens its workforce, not just whether minimum requirements are met.

Our standardized ratings provide insurers with a clear, comparable view of screening rigor across insureds, helping identify risk earlier and differentiate between exposures that appear similar on paper.

See Workforce Risk More Clearly

If workforce screening quality matters to your loss outcomes, C-Screen provides the visibility you’ve been missing.

Contact Us